Page 11 - HIP Housing Impact Report 2016-2017

P. 11

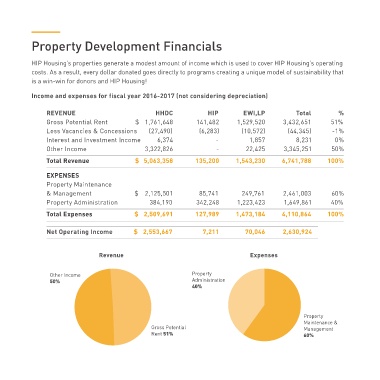

Property Development Financials

HIP Housing’s properties generate a modest amount of income which is used to cover HIP Housing’s operating

costs. As a result, every dollar donated goes directly to programs creating a unique model of sustainability that

is a win-win for donors and HIP Housing!

Income and expenses for fiscal year 2016-2017 (not considering depreciation)

REVENUE HHDC HIP EWI,LP Total %

Gross Potential Rent $ 1,761,648 141,482 1,529,520 3,432,651 51%

Less Vacancies & Concessions (27,490) (6,283) (10,572) (44,345) -1%

Interest and Investment Income 6,374 - 1,857 8,231 0%

Other Income 3,322,826 - 22,425 3,345,251 50%

Total Revenue $ 5,063,358 135,200 1,543,230 6,741,788 100%

EXPENSES

Property Maintenance

& Management $ 2,125,501 85,741 249,761 2,461,003 60%

Property Administration 384,190 342,248 1,223,423 1,649,861 40%

Total Expenses $ 2,509,691 127,989 1,473,184 4,110,864 100%

Net Operating Income $ 2,553,667 7,211 70,046 2,630,924

Revenue Expenses

Other Income Property

50% Administration

40%

Property

Maintenance &

Gross Potential Management

Rent 51% 60%